MANHATTAN BEACH, CA, January 5, 2020 – Affiliates of CriticalPoint Capital, LLC (“CriticalPoint Capital” or “CPC”) announced today the completion of the sale of Arlon Electronic Materials Division (the “Company” or “Arlon EMD” or “Arlon”) to Elite Material Co. Ltd. (“EMC”). Headquartered in Rancho Cucamonga, California, Arlon is a leading manufacturer of specialty, high performance laminate and prepreg materials for use in a wide variety of printed circuit board applications, primarily serving the aerospace and military end markets. EMC is Taiwanese-based, and the fifth largest copper clad laminate (CCL) and prepreg manufacturer, globally. EMC acquired Arlon in order to establish a North American manufacturing base to meet long-term market demand in the United States.

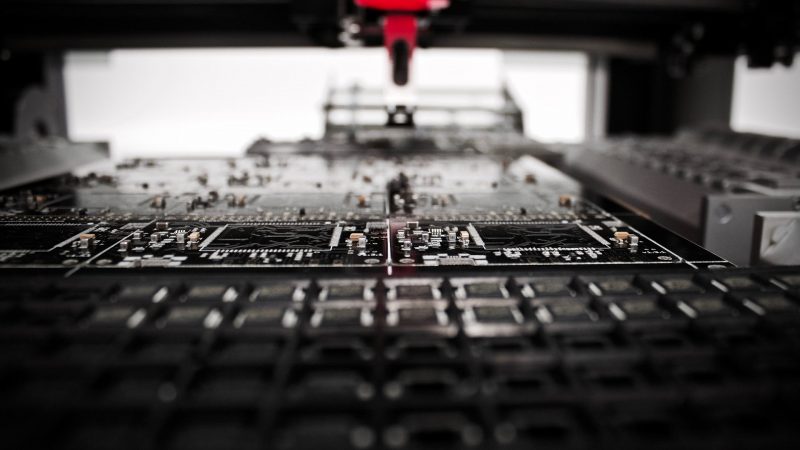

For over 50 years, Arlon EMD has earned a reputation as a specialty materials manufacturer, providing high quality products with reliable performance and quick-turn production capability. The Company focuses on developing and manufacturing niche products designed to address specific problems that OEMs and fabricators encounter in their design and manufacturing activities. The Company delivers a superior value proposition supporting high value, high risk applications where product failures have potentially extreme consequences.

Under CPC’s ownership since 2015, Arlon has undergone a significant facility expansion and equipment upgrade at its production site in Rancho Cucamonga. The upgrades and expansion of the 82,000 square foot facility resulted in an increase in manufacturing floor space of 35% and a 20% improvement in manufacturing efficiency. These upgrades enabled the Company to conduct additional quick-turn services and specialty product manufacturing. Further, Arlon expanded its product portfolio with the addition of four new products, demonstrating its commitment to constantly evolve to serve its customers’ needs. As a result, Arlon’s revenue and EBITDA grew during each year of CPC’s ownership.

“Our time together with Arlon and the management team led by Brad Foster has been incredibly fruitful,” said Brad Holtmeier, Partner at CPC. “During our partnership, the Company introduced new products, improved its manufacturing capabilities, and invested in significant capital improvement projects. We are proud of our investment into the organization and believe Arlon is well-positioned for growth with EMC’s leadership and substantial manufacturing and technical expertise.”

“We are grateful for CriticalPoint Capital’s financial and strategic support over the past five years,” said Brad Foster, President of Arlon. “Not only has CPC been instrumental in helping us attain our growth objectives, but they truly understand the key value drivers and overall investment strategy allowing me and my team to run the day-to-day business. The collaborative approach with CPC has enabled us to expand our market leadership and build tremendous positive momentum that will continue to drive the business forward.”

About Arlon EMD

Founded in 1969 and headquartered in Rancho Cucamonga, California, Arlon is a leading manufacturer of specialty high performance, laminate and prepreg materials for use in a wide variety of printed circuit board (“PCB”) applications. The Company provides various thermoset resin technology products for a variety of substrates including woven glass and non-woven aramid. The company offers specialty laminates for high temperature environment, high layer count PCBs, enhanced electrical properties and high-density interconnections. www.arlonEMD.com

About CriticalPoint Capital

Founded in 2012, CriticalPoint Capital is a private investment firm based in El Segundo, CA. The firm is focused on acquiring companies with long-term value creation opportunities and partnering with management teams that can benefit from patient capital and a thoughtful approach to growth. CPC’s portfolio is composed of investments across a wide variety of industries and the firm looks to grow through additional platform and add-on acquisitions.