"We have usually made our best purchases when apprehensions about some macro event were at a peak. Fear is the foe of the faddist, but the friend of the fundamentalist."

Warren Buffet, 1994 Letter to Shareholders

In a year marked by uncertainty related to inflation, Fed rate cuts, tightened lending standards, heightened geopolitical tension and a Presidential election, CriticalPoint remained steadfast in its pursuit of becoming the preeminent full-service M&A firm within the lower middle market. Throughout the year, the sentiment echoed by those involved in the deal ecosystem was ‘cautious optimism’ for a near-term recovery in transaction volume and velocity following two years of declining activity. That recovery was slow to materialize in the first half of 2024, but we saw renewed conviction for dealmaking and increased momentum in the second half of the year.

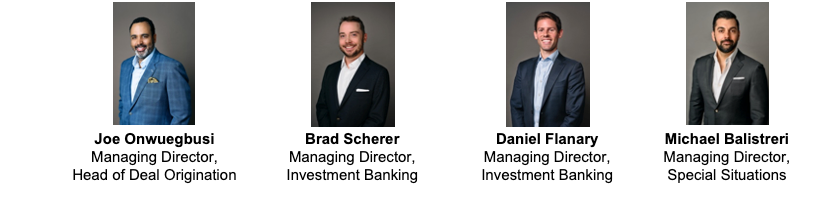

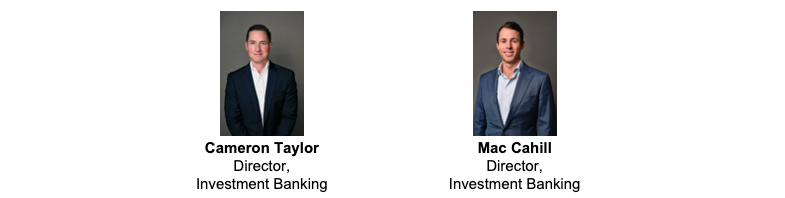

Amidst this backdrop of uncertainty, CriticalPoint seized the opportunity to expand its team, broaden its service offerings, and reaffirm its commitment to help clients achieve successful outcomes. Investments included:

- Welcoming Managing Directors and Directors to the CriticalPoint Team

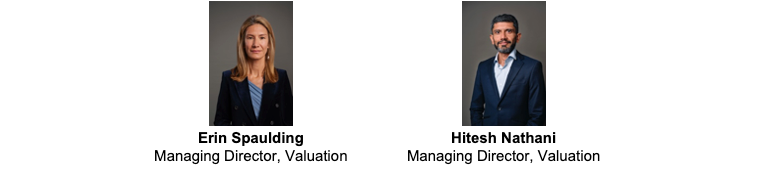

- Adding a Valuation Service Offering with the hiring of Managing Directors Erin Spaulding (Valuation) and Hitesh Nathani (Valuation)

- Expanding into Restructuring – our fifth service line – with the hiring of Managing Director Michael Balistreri (Restructuring)

- Launching the Alternative Buyer Program to expand our support of the independent sponsor, family office and capital provider ecosystems

These investments position CriticalPoint to better serve a more diverse client base across a greater range of investment banking needs.

The breadth of CriticalPoint’s service offering creates a wealth of perspectives and knowledge that enables us to synthesize key takeaways from 2024 and gain perspective on what may come in 2025. We’re excited to share these insights with you and celebrate some momentous wins and milestones for our firm.

Source | Deal Origination - Integrating New Technology to Expand Capabilities

We continue to expand and build our infrastructure to better serve our clients and support the rapidly growing need for alternative and more curated sources of proprietary deal flow. Over the past several months, the team has been busy significantly growing staff, investing in new systems, integrating AI tools for buy-side searches, and expanding its research capabilities to aid clients with thesis formation and market mapping. We’re also proactively constructing actionable target pipelines for specific investment strategies.

CriticalPoint is excited to announce the launch of a new client portal, CriticalPointConnect.com. With this portal, we will have better connectivity with Source clients and the ability to align priorities and action items more closely.

Additionally, CriticalPoint is in the final stages of launching a database within our client portal for additional proprietary deals across many industries and geographies. We continue to expand our search efforts into new and non-retained categories to build our deal database. This database is designed to be an added benefit for our most loyal and active clients. We hope these tools will bring value to our active clients in platform and add-on searches.

Lastly, CriticalPoint launched its Alternative Buyer Program which provides independent sponsors, family offices, high net worth individuals, search funds and direct lenders with access to an inventory of proprietary deals generated by our sourcing and business development efforts, as well as offer a host of other resources and services as needed. This approach aligns with CriticalPoint’s commitment to staying at the forefront of the industry and serving the middle and lower-middle market deal ecosystem.

If you would like more information about CriticalPoint’s Source Deal Origination capabilities and systems, please contact:

Joe Onwuegbusi

Managing Director, Head of Deal Origination

Direct: (424) 567-6182

jonwuegbusi@criticalpoint.com

Execute | Investment Banking - Advising Prudently Amidst the Tumult

Sell-side Mergers & Acquisitions

The beginning of 2024 was a continuation of the challenging M&A environment from the previous year. Uncertain macroeconomic and geopolitical climates, as well as concerns surrounding continued impacts of inflation both on businesses and consumers, held back a full recovery in M&A activity, particularly for private equity sellers and businesses of scale.

During the year, CriticalPoint successfully led numerous transactions across a range of industries by leveraging our team’s extensive expertise. Notable transactions include:

As the year progressed, resilience in the U.S. economy and an improvement in financing conditions created some momentum, albeit still muted from the post-COVID peak. Sellers’ expectations have begun to moderate to current market conditions with valuations remaining below peak years and the level of recovery being variable by sector.

Buyers exhibit a dichotomous approach to dealmaking. Private equity investors continue to sit on record amounts of dry powder from recently raised funds and are expressing a strong desire to deploy that capital. At the same time, those investors are taking a thorough approach to due diligence with a focus on managing against potential economic disruption and inflationary pressure. As a result, sellers are asked to accept structure (seller notes, earn outs, etc.) as a part of deal frameworks to mitigate buyer risk.

Business owners and private equity investors are still adjusting to the permanent upward shift in pricing levels, which has been an ongoing source of tension as firms balance maximizing demand and maintaining margins. Inflation-driven disruption seems to be waning, but the risk of resurgence remains real for investors.

Looking forward to 2025, market sentiment is for a continued recovery of M&A activity. With expectations for a continued decline in interest rates, a stronger business environment with the new administration, and continued strength in the U.S. economy, we expect to see an uptick in completed deals albeit with a continuation of cautious behavior from buyers.

If you would like more information about CriticalPoint’s Sell-side Mergers & Acquisitions capabilities and solutions, please contact:

Curt Himebauch

Managing Director, Business Development

Direct: (424) 567-6198

chimebauch@criticalpoint.com

Institutional Loan and High Yield

Debt capital markets conditions were favorable for borrowers throughout the year driven primarily by the dearth of M&A-driven deal flow, and the strong pace of capital formation through CLO issuance and inflows into prime rate funds and ETFs. The leveraged loan and bond markets experienced a surge in volume, growing an estimated 95% and 65%[1] respectively over the prior year, with a majority of the volume driven by opportunistic repricings (~50%1). These conditions produced heavy demand for good deals, and resulted in tighter credit spreads, looser terms and a consistent rise in secondary levels. Whereas in prior years only the cleanest, highest quality deals attracted capital, this year lenders adopted a more constructive approach in their underwriting in order to deploy more capital. Leverage covenant cushion levels, EBITDA adjustments, greater acceptance of dividend recapitalizations, and the willingness to buy into the stories of challenged credits are just a few of the trends shaping the past year. With the U.S. election in the rear view, a Federal Reserve easing cycle in-flight, and growing confidence in the macroeconomic outlook, all focus has shifted to 2025 for a resurgence in M&A activity and a consequent rise in financing volume.

In September, CriticalPoint served as exclusive debt advisor to global communications company Viasat, Inc. (“Viasat”) on its issuance of $1.975 billion Senior Secured Notes. CriticalPoint provided key strategic, tactical and technical advice relating to capital structure, capital markets, timing, pricing and capital providers. CriticalPoint’s independence, combined with its deep experience in debt capital markets, helped Viasat to confidently and efficiently craft a successful financing solution, while also planning for longer-term capital and strategic objectives.

If you would like more information about CriticalPoint’s Capital Markets capabilities and solutions, please contact:

K.C. Brechnitz

Managing Director, Head of Capital Markets

Direct: (424) 310-0213

kbrechnitz@criticalpoint.com

Invest | Private Capital - Astutely Deploying Capital

Private Equity

On the investing front, 2024 mirrored many themes of the prior year – market participants continually navigated macroeconomic, geopolitical and industry-specific challenges among the backdrop of a national election, which forced increased resiliency, flexibility and ingenuity. While many business owners and corporates took a wait-and-see approach to better gauge the Federal Reserve’s policy path and the broader political landscape, liquidity management and increased emphasis on operational efficiency remained at the forefront. Similarly, private equity firms continued the trend of holding portfolio companies longer, while looking to optimize those companies and enhance value through add-on acquisition strategies.

Meanwhile, as large corporates focused on their core businesses, we saw an uptick in corporate divestitures and expect similar activity into the first half of 2025. As lending markets began to stabilize, investor appetite for longer-term themes seemed to dominate headlines to include AI-enabled cloud computing capabilities, data centers and the underlying infrastructure to support them, namely nuclear power generation. The tailwinds for these infrastructure investments appear to be strong and with a renewed push for onshoring, we expect dealmaking in the space to persist into the future.

As we look internally, just prior to year end CriticalPoint closed the sale of our portfolio company, United Engineers & Constructors, to the publicly traded company, Aecon Group, Inc. The most recent deal closing represents the final exit of our investment in United following the divestiture of United’s Energy Delivery segment, which was previously acquired by United Grid Solutions, LLC, a subsidiary of Pike Corporation, in a separate transaction in May 2024. The two distinct sales are full-lifecycle demonstrations of our firm’s flexibility and expertise in corporate divestitures as part of our private capital platform.

In many respects, 2024 felt like a recalibration year following the global pandemic, supply chain disruptions and inflation fight – private equity investors showed their persistence and ability to evolve and drive positive outcomes for stakeholders through disciplined cost management while targeting sector-specific growth opportunities, which remain essential and endure all economic cycles.

If you would like more information about CriticalPoint’s Private Equity capabilities and solutions, please contact:

Luke Ewing

Managing Director

Direct: (310) 697-8767

lewing@criticalpointcapital.com

Private Credit

The fast-growing private credit market continues to adapt and disrupt the traditional lending markets, competing directly for new issues not only in the traditional corporate lending markets, but also expanding into the more esoteric areas of credit such as infrastructure, consumer finance and investment grade. The technical supply-demand imbalance present in the institutional markets mentioned above also exists in the private credit market with lenders sitting on large stockpiles of committed capital and experiencing the same slow deal market. Private credit maintains its allure with attractive attributes such as flexible structuring, certainty to close, no credit ratings and visibility on terms and conditions. However, as the resurgence of the large-cap institutional markets recaptures market share from the largest direct lenders, they continue to look for ways to differentiate such as allowing for more PIK interest features in their loans to relieve borrowers from high cash interest burdens.

In the middle-market and lower-middle-market, competition remains fierce and should persist. As a differentiation strategy, we continue to see private credit firms partnering with traditional banks. These partnerships include banks providing financing to private credit lenders, distributing private credit products to their clients, and leveraging their origination and risk-management functions to improve deal flow and execution.

The past year marked a pivotal period for valuation services, with trends highlighting the increasing integration of holistic wealth advisory, particularly for high-net-worth individuals and family offices. Estate tax valuations, especially in light of the Connelly decision, underscored the importance of defensible, tax efficient transfer strategies, timely planning, and that here, objectivity is best outsourced.

If you would like more information about CriticalPoint’s Private Credit capabilities and solutions, please contact:

K.C. Brechnitz

Managing Director, Head of Private Credit

Direct: (424) 310-0213

kbrechnitz@criticalpointcapital.com

Valuation – Navigating Complexity to Deliver Clarity

The past year marked a pivotal period for valuation services, with trends highlighting the increasing integration of holistic wealth advisory, particularly for high-net-worth individuals and family offices. Estate tax valuations, especially in light of the Connelly decision, underscored the importance of defensible, tax efficient transfer strategies, timely planning, and that here, objectivity is best outsourced.

To stay ahead of increasing valuation needs of clients, sponsors, partners and founders, we continue to grow our Valuation team and add capabilities across all valuation types.

As we move into 2025, the Valuation team is prepared to navigate the anticipated complexities brought by potential updates to FASB standards, particularly around asset impairment and disclosures. Improved disclosure requirements for public companies around digital assets, reporting segments, disaggregated taxes, and joint venture formations will directly influence transaction accounting. Perhaps more importantly, it should provide greater transparency to investors and clarity in private company valuations by making the identification and alignment of similar segments, assets and taxation possible for analysts, and improve cash flow forecasting.

With these tax and financial reporting updates in effect, we anticipate a surge in demand for our transaction advisory and exit planning service lines as market conditions stabilize. Private equity backed firms and founders contemplating liquidity events can lean on our accurate and forward-looking valuations and a deep bench of advisory support services to optimize outcomes.

If you would like more information about CriticalPoint’s Valuation capabilities and solutions, please contact:

Erin Spaulding

Managing Director, Valuation

Direct: (310) 986-8284

espaulding@criticalpoint.com

Looking Forward

Revamping our mission and core values statement was another foundational investment of 2024 that will help guide our actions and build our culture. It reads:

At CriticalPoint, our mission is to cultivate a client-first culture driven by entrepreneurship and teamwork which enables us to consistently deliver exceptional results for our valued clients and business partners, and to advance our company for long-term success.

We care deeply about our clients: founders, owners, private equity clients, and management teams. We maintain integrity in our relationships to ensure that we are trusted advisors, honest investors, and exceptional colleagues respected for the results we deliver.

We ended our prior year’s update noting, “we feel there is a lot to be excited about in 2024.” For CriticalPoint, that prediction came true. CriticalPoint consistently engineered great client outcomes and will exit the year better positioned to exceed client expectations in 2025.

Optimistically, we feel there is even more to be excited about in 2025. Strategic acquirers retain large cash balances, private equity remains flush with uninvested capital, banks are lending, inflation no longer dominates the headlines, and the new administration is expected to employ a lighter hand to regulatory and antitrust efforts. Potential detractors to a recovery are tariffs and mass deportations, which would be disruptive and potentially reignite inflation. On balance, the indicators are positive and supportive of an open and productive environment for transactions in 2025.

Now is a great time to reach out if you are considering a transaction, planning for growth, or wanting to learn about our expanded service offerings – we’d love to hear from you. From all of us at CriticalPoint, we hope you enjoyed the holidays and wish you a very happy new year.

Contributing Authors:

Brad Scherer

Managing Director, Execute

Direct: (512) 796-0556

Email: bscherer@criticalpoint.com

Nick Cipiti

Managing Director, Execute

Direct: (310) 321-4172

Email: ncipiti@criticalpoint.com

K.C. Brechnitz

Managing Director, Head of Private Credit

Direct: (424) 310-0213

About CriticalPoint

Headquartered in Los Angeles, CriticalPoint is a leading full-service financial M&A firm that uniquely combines the best of investment banking, private capital, and valuation service offerings. CriticalPoint executes, sources, and invests in deals across a wide variety of industries for the traditionally underserved middle market. Since our founding in 2012, our mission has been to serve the needs of owners, entrepreneurs, management teams, and stakeholders with our experience, knowledge, and expert judgment, to help them realize their companies’ greatest potential. From our deep-rooted foundation in private equity and investment banking, and our devotion to deal origination and business development, combined with being entrepreneurs at heart, we believe we are differentiated and well positioned to help companies wherever they are in their life cycle.